Stats on star investors usually show how they’ve beaten the market or highlight their one rockstar stock. Talk about Big Bull, aka Rakesh Jhunjhunwala, too, usually centres on his legendary picks such as Titan and Crisil. But there is one investment bet in his 26-stock portfolio that has gone bust, spectacularly.

In 2006, Jhunjhunwala paid Rs 20-odd crore for a 21% stake in A2Z Maintenance & Engineering Services, an engineering, procurement and construction (EPC) company engaged in power distribution and facility management services (FMS) among other interests. In 2010, it went public, raising Rs 776 crore (fresh issue of Rs 675 crore and offer for sale of Rs 101.25 crore). Under the offer for sale, Jhunjhunwala sold over 1 million shares at Rs 400 a share, pocketing over Rs 40 crore.

But the gains evaporated on the very first day, when the stock tanked on listing. To soothe frayed nerves, Big Bull bought 1.375 million shares at Rs 350.77 a share, forking out Rs 48 crore. At the end of the quarter his 19.11% stake was still worth a respectable Rs 450 crore. But the stock continued to head southward. Again on May 22, 2012, Jhunjhunwala bought 2.65 million shares for Rs 26 crore at Rs 100 a share, thus pumping in an additional Rs 75 crore in the company and raising his stake to 22.68%.

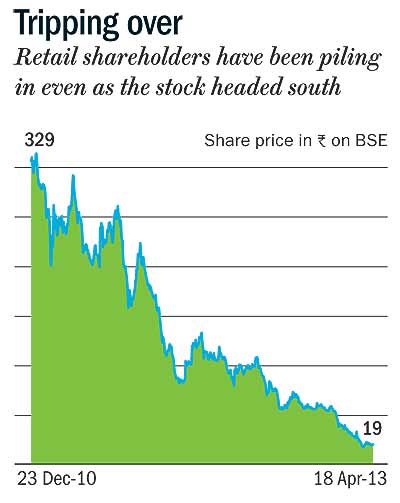

But the gains evaporated on the very first day, when the stock tanked on listing. To soothe frayed nerves, Big Bull bought 1.375 million shares at Rs 350.77 a share, forking out Rs 48 crore. At the end of the quarter his 19.11% stake was still worth a respectable Rs 450 crore. But the stock continued to head southward. Again on May 22, 2012, Jhunjhunwala bought 2.65 million shares for Rs 26 crore at Rs 100 a share, thus pumping in an additional Rs 75 crore in the company and raising his stake to 22.68%.Today, in just two years, the stock has come off 94% to Rs 19.45 as on April 18, against a 4% fall in Sensex. Though Jhunjhunwala sold part of his stake in March, at 18% he is the biggest non-promoter shareholder and the stock remains the biggest bet, in percentage holding terms, within his portfolio. But its value is now a paltry Rs 25 crore.

What went wrong with A2Z? For starters, it bit off more than it could chew, starting off as an FMS provider and moving on to installing power distribution lines and sub-stations. However, with power distribution a shambles, the sector was de-rated by the Street. Besides, A2Z allocated a chunk of the IPO proceeds for its biomass plants of 60 MW, but has been facing delays in execution and signing power purchase agreements.

While analysts had panned the IPO for its aggressive multiples [26 times, against the then-industry multiple of 15x for EPC companies], what raised eyebrows was how profit and margins plummeted dramatically post listing. From a profit of Rs 93 crore in FY10, prior to listing, A2Z posted a Rs 19 crore loss in FY12. And for the nine months of FY13, the loss widened to Rs 25 crore on sales of Rs 436 crore. To top it all, the company’s debt piled up from Rs 405 crore to over Rs 1,100 crore as of FY12.

The Street sensed something was amiss when Jhunjhunwala stepped down as director in late 2012 and also pulled out his nominee director, Manish Gupta, early this year. Rajeev Thakore, an independent director, too resigned from the board and earlier, in 2012, the company’s group CFO too quit to become a ‘financial advisor’ to the company.

Still, retail investors piled into A2Z — perhaps thinking they were getting a stock with a marquee investor cheap — and their numbers doubled from 12,000-odd as of December 2010 to over 24,000 by March 2013. Last heard, the management referred the company to the corporate debt restructuring cell. It remains to be seen whether A2Z gets bailed out. But for now, A2Z has turned out to be the biggest dud in RJ’s portfolio.

outlook.com